Maximizing Value: Preparing Your South Florida Home for Sale and Securing the Ideal Mortgage

Selling a home in South Florida’s fast-paced real estate market is both exciting and challenging. Whether you’re moving locally or relocating out of state, understanding how to prepare your property and how buyers obtain financing can make the process far smoother. From sprucing up your home’s presentation to handling essential repairs and exploring mortgage options, a well-thought-out plan ensures you get top value for your property and help buyers move forward with confidence.

Note:

Thinking “electrician near me” in West Palm Beach? Gold Standard Electric provides expert, reliable electrical services for your home or business. Call us today for a free estimate!

Creating Curb Appeal and a Welcoming First Impression

In South Florida’s competitive housing market, presentation can make or break a sale. Buyers often decide within seconds whether a property feels right, so your goal is to transform your home into a space where potential buyers can picture themselves living comfortably.

Start by decluttering and depersonalizing every room. Remove unnecessary furniture, personal photographs, and items that make the home feel too customized to your family. Minimalism helps showcase the property’s natural light, space, and architecture. Use neutral décor to create a relaxing environment that appeals to a broad audience. Renting a small storage unit for off-season clothes, collectibles, or bulky items can free up space and make each room appear larger.

Next, schedule a deep cleaning. Every corner of the house—from window tracks to baseboards—should shine. If possible, hire professional cleaners before showings begin. Buyers are immediately drawn to spotless homes because cleanliness reflects how well the property has been maintained. Opt for natural scents or fresh air instead of heavy air fresheners, which can make visitors suspicious that you’re covering up odors.

Staging also plays a major role in helping buyers emotionally connect to the space. You don’t need a complete redesign—just thoughtful touches. Rearrange furniture to maximize open flow and light, replace outdated linens, and add subtle decorations such as fresh flowers or a bowl of fruit on the kitchen counter. Each room should serve a clear purpose and feel inviting without clutter.

Finally, don’t overlook curb appeal, which is especially important in tropical South Florida. Mow and edge the lawn, trim overgrown bushes, and pressure wash sidewalks and driveways. Repainting your front door, updating the hardware, and adding soft outdoor lighting can completely change the home’s first impression. A few potted plants or colorful flowers will enhance the entryway and make the exterior look cheerful and cared for.

Addressing Key Systems: AC, Electrical, and Home Maintenance

Beyond appearance, the condition of your home’s major systems—particularly air conditioning, electrical, and plumbing—can make or break a deal. Florida buyers are especially cautious about these areas due to the state’s heat, humidity, and hurricane season.

Air Conditioning (HVAC): In South Florida, a functioning air conditioner isn’t a luxury—it’s a necessity. A weak or failing unit raises red flags for potential buyers. Before you list your home, hire a licensed HVAC professional, such as the team at City ACS, to perform an inspection and tune-up. Technicians can clean coils, check refrigerant levels, and verify that the system runs efficiently. Having documentation of a recent inspection reassures buyers that your home is well cared for. If your AC unit is old, replacing it with an energy-efficient model can be a selling advantage. Buyers often see newer systems as a reason to make a higher offer since it means fewer future repairs and lower energy bills.

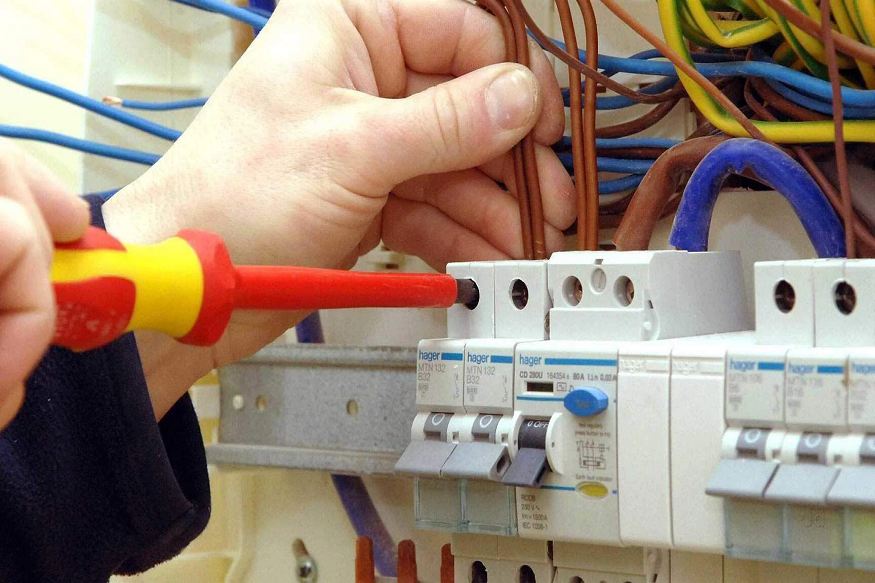

Electrical Systems: Modern buyers expect safety and functionality. Faulty wiring, flickering lights, or outdated panels can raise immediate concerns. To avoid losing buyers over inspection results, consider a professional evaluation by a licensed electrician such as Gold Standard Electric or Vincent Electric. These professionals can identify and fix any code violations, upgrade outdated panels, and ensure all outlets—especially GFCIs near water—work properly. Even simple upgrades, like adding more outlets or installing smart switches, can boost your home’s appeal.

Note:

Got AC trouble? Searching “AC repair near me” in Davie, FL? City ACS delivers prompt, reliable air conditioning service to keep you cool. Schedule your repair today!

Plumbing and Minor Repairs: Don’t underestimate small fixes. Leaky faucets, sticking doors, or loose tiles might seem trivial but suggest neglect to buyers. Handling these repairs before listing your property demonstrates care and pride of ownership. Many sellers also benefit from a pre-listing home inspection. This allows you to discover potential problems early and handle them on your schedule, instead of under the pressure of a buyer’s demands. Addressing these issues in advance can lead to smoother negotiations and prevent last-minute deal breakers.

Securing Financing: Helping Buyers Achieve the Dream

While you prepare your home for the market, buyers are working on securing the right mortgage. Understanding how financing works helps sellers gauge buyer readiness and smooth out the closing process.

Pre-Approval: A mortgage pre-approval is a lender’s written commitment stating how much a buyer qualifies to borrow. It’s stronger than a simple pre-qualification and gives the buyer an edge in competitive markets like Miami, Fort Lauderdale, and Palm Beach. Sellers should always favor offers backed by pre-approval letters, as they signal that the buyer’s finances have been verified.

Types of Mortgages:

- Conventional Loans: These are ideal for buyers with solid credit and a good down payment. They offer flexibility and competitive rates but usually require at least 5–20% down.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans make homeownership accessible to first-time buyers with smaller down payments and lower credit scores.

- VA Loans: Designed for veterans and active-duty military, these loans often require no down payment and come with attractive interest rates.

- Fixed-Rate Mortgages: These loans maintain the same interest rate over the life of the loan, providing predictability in monthly payments.

- Adjustable-Rate Mortgages (ARMs): These start with a low fixed rate for a few years, then adjust based on market conditions—ideal for buyers who plan to sell or refinance before rates rise.

Choosing a Lender: Buyers often wonder whether to use a mortgage broker or go directly to a bank. A broker works with several lenders to find the best rate and terms for your situation. A direct lender, such as a bank or credit union, offers in-house products that can be more streamlined. Comparing both options ensures buyers get the most favorable deal.

Comparing Offers: Even a small difference in interest rates—say, 6.5% versus 6.3%—can save thousands over the life of a mortgage. Buyers should carefully review loan terms, fees, and closing costs, including appraisal and title insurance. Transparency and understanding the total cost of the loan are key to making a confident financial decision.

Bringing It All Together

Selling a home and purchasing another are often intertwined journeys. In South Florida’s fast-moving real estate market, preparation and professional guidance make all the difference. By addressing your home’s appearance, ensuring critical systems are in top shape with trusted experts like City ACS, Gold Standard Electric, and Vincent Electric, and understanding how mortgage financing works, you can move confidently through each step.

The process may seem complex, but with careful planning, attention to detail, and the right professionals on your side, you can maximize your home’s value, attract serious buyers, and enjoy a smooth transition to your next home in beautiful South Florida.

Note:

Note: We are a quality mortgage brokerage firm in South Florida that provides great, competitive rates with flexible types of loan packages. Need a Mortgage broker Near Me click here.